The National Disability Insurance Scheme (NDIS) is managed by the National Disability Insurance Agency. The scheme is meant to help improve the quality of life for Australians with significant disabilities.

Currently, the NDIS supports more than 500,000 Australians with disabilities to access necessary support and relevant services that’ll allow them to live comfortably.

What Does an NDIS Business Do?

NDIS businesses or providers serve as contact points for NDIS participants. While the NDIS funds the necessary services and support for the disabled, the businesses in the NDIS industry provide these specific services and support.

In recent years, more people have started benefitting from the NDIS scheme. This has also opened opportunities for those hoping to serve in the disability industry.

However, it is important to remember that while an NDIS business can be a profitable venture, all registered and unregistered NDIS businesses must adhere to certain standards set by the NDIA. These also include tax and other compliance-related requirements.

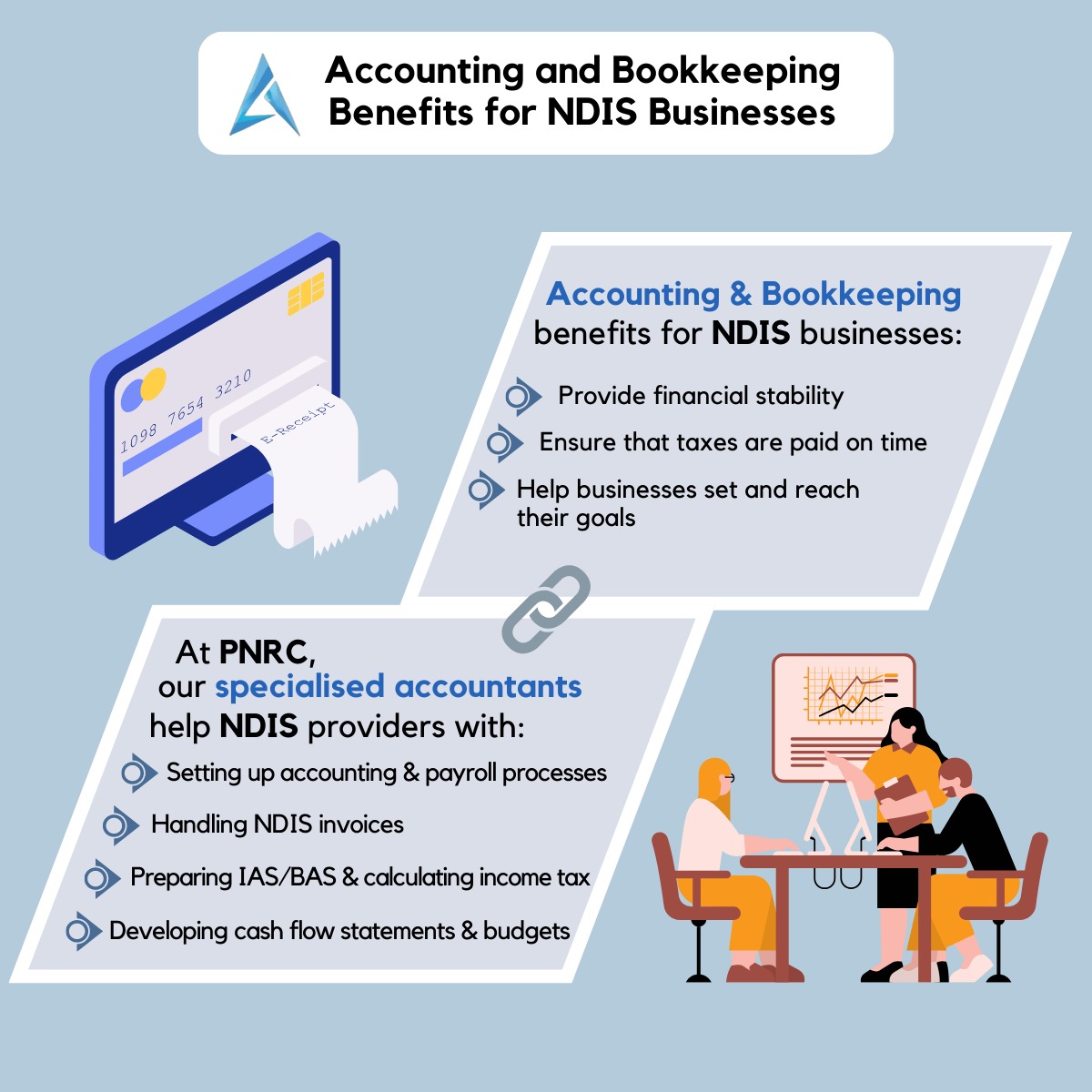

How Can Accountants Help with Compliance?

Professional accountants are experts in finance-related tasks and can help your NDIS business stay on top of all compliance requirements and other ATO obligations. They can review and restructure your business to ensure it aligns with the guidelines but also with your financial objectives.

Moreover, accountants can help make sure that your assets are always protected, and they can help you minimize tax where possible. Things like BAS lodgments, payrolls, and income tax returns are also processes that an accountant can easily manage. On the other hand, these basic compliance and reporting requirements may take hours of your time, keeping you from focusing on other critical business operations.

Here are a few tasks a qualified accountant can help your NDIS business with:

- Comprehending and complying with all NDIS regulations

- Meeting tax obligations

- Managing your finances and cash flow

- Handling invoicing process

How Can PNRC Help Your NDIS Business in Australia

As accounting and advisory experts, the team at PNRC can help you with many aspects of your NDIS business. Here are a few examples:

- Set up accounting software

- Set up payroll processes

- Accounting & reporting (monthly, quarterly, and yearly)

- Develop cash flow statements and budgets

- IAS/BAS preparation

- Tax reconciliation

- Calculating income tax

- Lodging tax returns

- Handling NDIS invoices

- Profit and loss/balance sheet statements

- Customer invoicing

- General help for initial processes (setting up an NDIS business)

- Help with NDIS price guide

PNRC has the best tax planners and we can help you with everything from financial consulting to business growth advisory services.

Kindly get in touch for any further information.