A Business Activity Statement (BAS) is a tax reporting obligation for many NDIS businesses issued by the ATO. It includes mandatory and additional taxes businesses need to pay during a specific period:

- GST

- PAYG Income Tax Instalment

- PAYG Tax Withheld

- FBT Instalment

- Fuel Tax Credits

- LCT

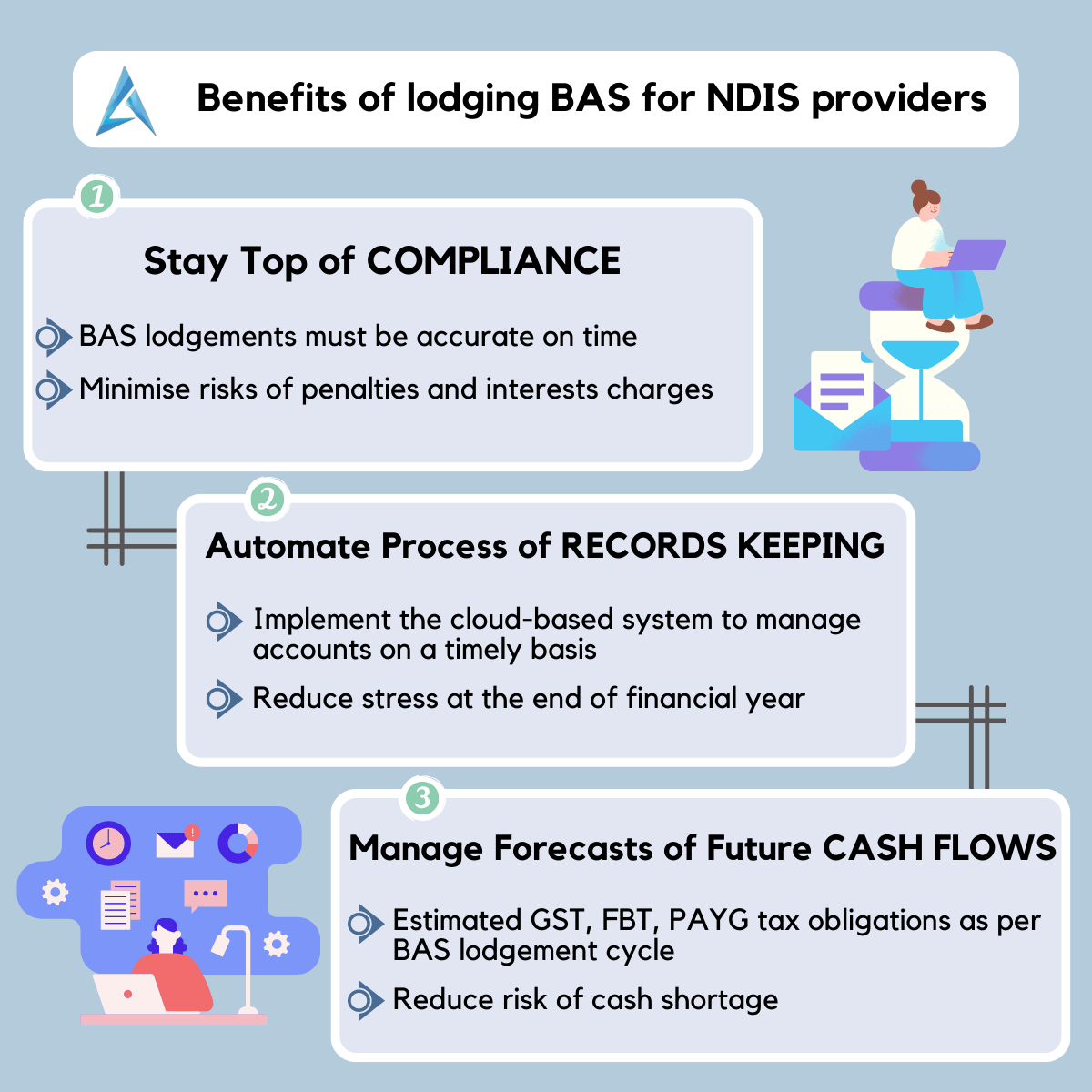

Lodging your BAS on time not only fulfils one of your obligations to the ATO, but it can also be beneficial to your business in many ways, such as:

1. You avoid late penalties

The lodgements of BAS have the strict due dates and must be accurate or you could be at risk of penalties – which is why it is beneficial to have the accounting professionals at PNRC to manage your BAS lodgements. If you lodge your BAS after the due date you may be subject to a failure to lodge penalty from the ATO. The fines can vary in amounts and can be higher if you have a poor lodgment history.

2. You can see how your business is progressing

By lodging your BAS on time every quarter, you are provided with a snapshot of your business’ financial position. From quarter to quarter, you can accurately track your business performance and growth.

3. You’ll have time to organise a payment arrangement

The ATO understands that debt is often a temporary problem for businesses caused by unforeseen personal circumstances or short-term downturn. To help, the ATO offers assistance to small businesses experiencing financial difficulties by offering them the option of a payment plan under certain circumstances.

4. Keep a good lodgment history

As an NDIS provider and operating your NDIS business, sometimes, there are situations arise when you find yourself in a situation that may require a deferral of payment, or if you need to organize a payment arrangement, a good history will you give you an advantage. Lodging your BAS on time means that you maintain a good lodgment history with the ATO.

5. You will have more time to focus on running your own business

By lodging your BAS on time, you will have more time to focus on running your business. Remember, even if you can not pay on time, you still need to lodge your activity statement on time or you may be charged penalties and interest.

Why to choose PNRC for your bookkeeping and BAS requirements?

At PNRC, we use cloud-based applications to automate the process of bookkeeping & BAS reporting. You can leave us the paperwork to be handled and focus on your productive tasks and business growth. Besides, all accounts get updated on a timely basis. It is beneficial to monitor the business transactions. Keeping proper records as substantiation during the financial year will reduce the pressure when you are going to deal with the tax return at the end of year.

Our expert team of accountants can help with estimating tax obligations in the next reporting period. For example, if you are planning to get more support workers to join your team, the amount of PAYG tax withheld is expected to be increased. It is better to have a plan to keep sufficient cash flows for the tax obligation.

If you need assistance with your BAS or bookkeeping needs, our experienced team of accountants can help.

Submit an online enquiry or call us on 0412929063 to arrange an appointment.