The National Disability Insurance Scheme (NDIS) has revolutionized the way disability services are provided in Australia. It has significantly enhanced the quality of life for people with disabilities by ensuring they have access to the support and services they need. However, the implementation of NDIS has also brought about its own set of challenges, particularly in the financial management of NDIS providers. This blog post will discuss some common accounting mistakes made by NDIS providers and how to avoid them.

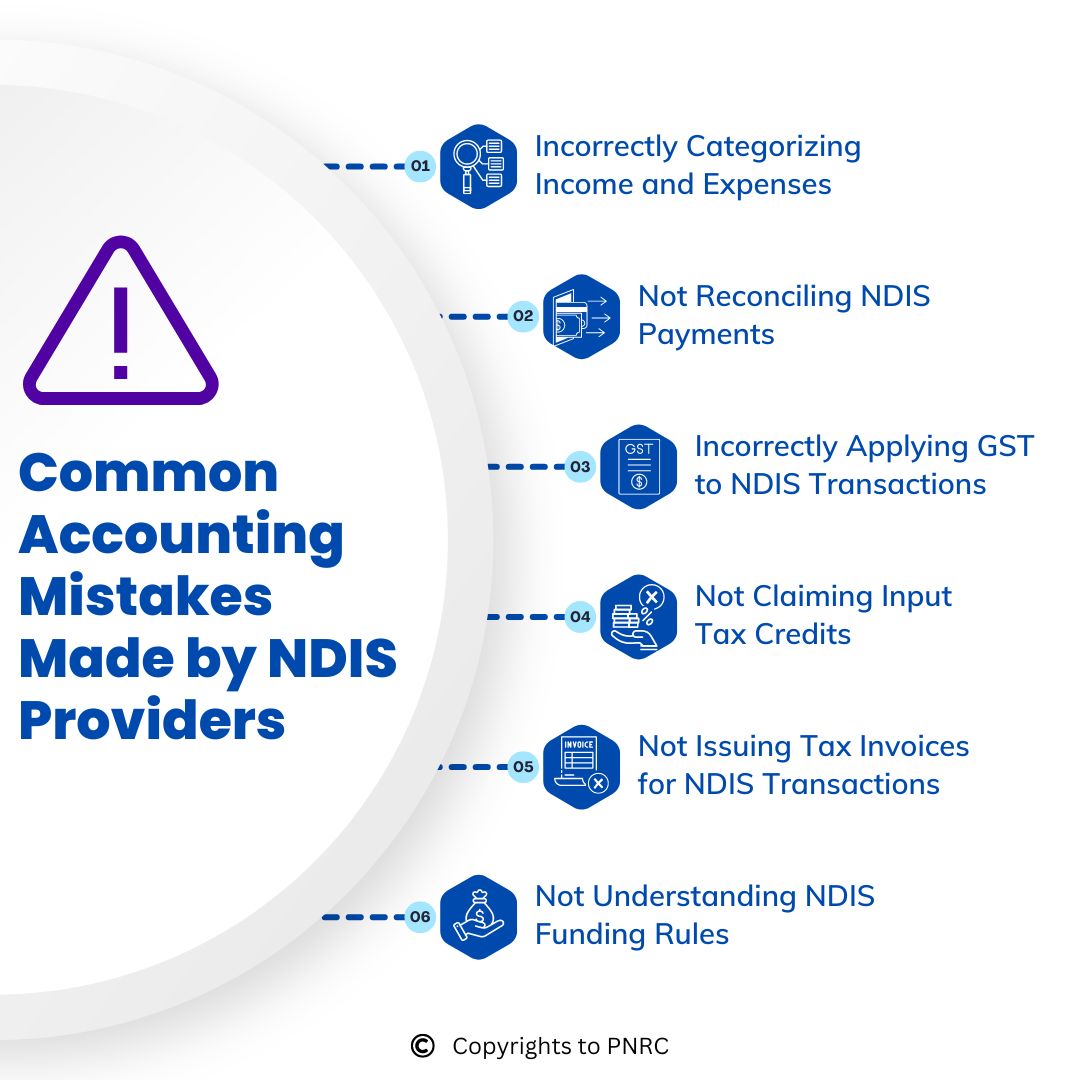

Mistake #1: Incorrectly Categorizing Income and Expenses

One of the most common accounting mistakes made by NDIS providers is incorrectly categorizing income and expenses. This can result in a misrepresentation of the financial health of the organization.

All income received by an NDIS provider should be correctly categorized as ‘NDIS income’. This includes the funding received from the NDIS for providing services. On the other hand, the expenses incurred by the provider should be categorized as ‘NDIS expenses’. This ensures that the financial statements present a true and fair view of the provider’s financial position.

Mistake #2: Not Reconciling NDIS Payments

Another common mistake is not reconciling the NDIS payments. Providers receive payments from the NDIS for the services they provide. These payments need to be reconciled against the provider’s records to ensure that all services have been correctly billed and paid for.

Failure to reconcile NDIS payments can result in significant discrepancies in the provider’s financial statements, leading to potential issues with the NDIS Quality and Safeguards Commission.

Mistake #3: Incorrectly Applying GST to NDIS Transactions

Goods and services tax (GST) is a broad-based tax of 10% applied to most goods and services consumed in Australia. However, not all transactions are subject to GST.

NDIS providers, like all businesses, need to correctly apply GST to their transactions. Incorrectly applying GST can lead to overbilling or underbilling, both of which can have serious financial implications.

Mistake #4: Not Claiming Input Tax Credits

While some NDIS providers are diligent in applying GST to their transactions, they often forget about claiming input tax credits. Input tax credits can significantly reduce the GST payable by a provider. This is because GST is a consumption tax, and businesses are entitled to claim credits for the GST they have paid on their inputs.

Mistake #5: Not Issuing Tax Invoices for NDIS Transactions

Tax invoices are a vital part of the financial record-keeping process for NDIS providers. They serve as proof of the transactions and are required for claiming GST credits.

Providers need to ensure that they issue tax invoices for all NDIS transactions, regardless of the amount. Failure to do so can result in delayed payments, incorrect financial statements, and potential penalties from the ATO.

Mistake #6: Not Understanding NDIS Funding Rules:

A solid grasp of the NDIS system and funding rules is essential for accurate record-keeping and claiming. Familiarise yourself with the NDIS Price Guide, which outlines the specific funding rates for different support categories. The NDIS National Provider Guide provides valuable information on service delivery and compliance requirements. Staying up-to-date on NDIS policy changes is crucial, as the system constantly evolves.

Good financial management is essential for any NDIS provider to succeed. You don’t have to go through it alone! Our firm specializes in working with NDIS providers. PNRC can help you set up a robust bookkeeping system, ensure compliance with NDIS regulations, and free you up to focus on what you do best—providing exceptional support to your clients.

Don’t wait until a financial hurdle trips you up. Invest in strong accounting practices now, and watch your NDIS business thrive.