What is Payroll in accordance with the SCHADS Award for NDIS Providers?

Social, Community, Home care & Disability Services Award commonly known as SCHADS Awards, is one of the complex awards due to numerous pay conditions and pay categories. NDIS Providers are required to comply with the SCHADS Award while processing payroll. Payroll is the process of paying a company’s employees, which includes tracking hours worked, calculating employees’ working hours in accordance with SCHADS Award, entering data into accounting software and processing payment via direct debit.

Major issues for NDIS providers while processing payroll

The major issues for NDIS providers while processing payroll are as follows :

- With numerous employees and their working conditions, the pay rates are different as per SCHADS Award.

- With numerous pay categories and pay conditions in SCHADS Award, it becomes time-consuming and difficult for NDIS Providers to do payroll. With multiple components, the job gets more complicated.

- 70% of the companies have not automated their payroll process.

- You might be overpaying the staff or there is a delay in payments, which resulted in a financial loss or increase in staff turnover.

- Also, the accounting team might not have enough information in correspondence to the SCHADS Award, thereby making the payroll and the transactions recorded incorrectly.

- Most softwares used by NDIS PROVIDERS charge per employee. Recurring costs are INVOLVED thereby creating another expense for your business.

How does PNRC resolve this issue?

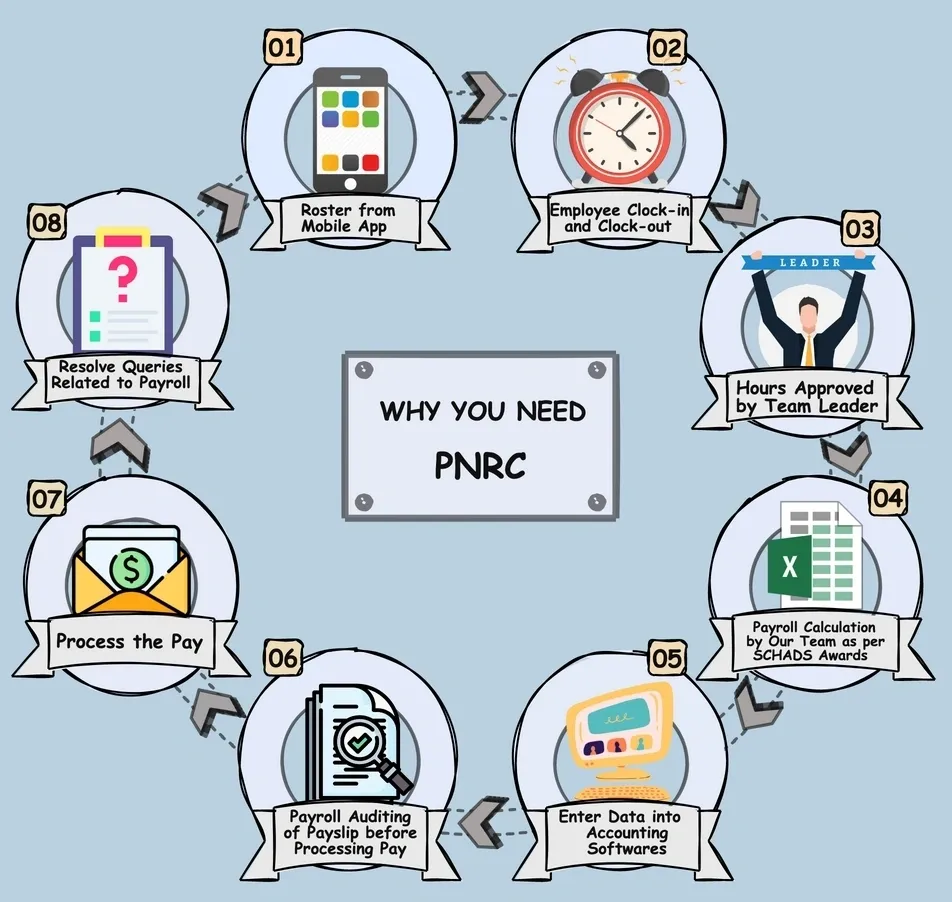

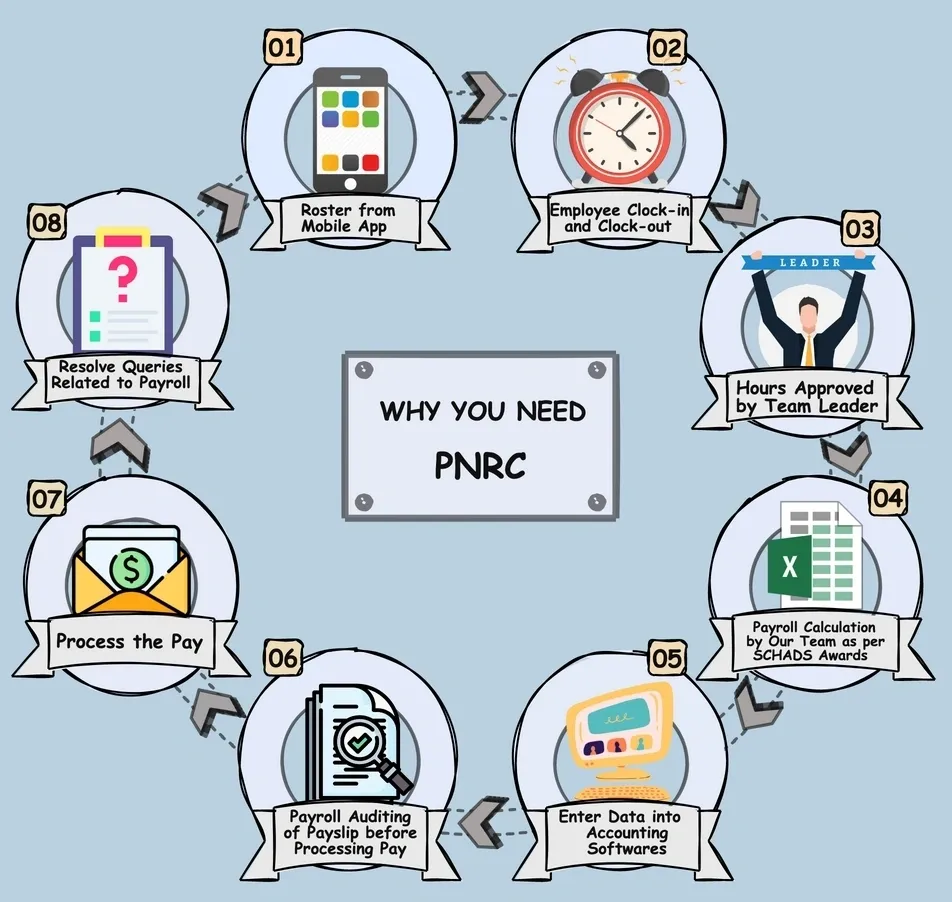

Payroll Process :-

- The support workers will choose their shifts based on the Roster.

- Support workers will be clocking in and clocking out.

- Team leaders will approve the shifts.

- Calculation of payroll as per SCHADS Award from approved shifts and preparing summarized excel sheet i.e. Card File to enter data in accounting software.

- When it comes to entering data in accounting softwares like XERO, MYOB & Quickbooks, there are some limitations, so we have to manually enter that data.

- Auditing payslip before processing pay avoids any errors.

- Processing pay through direct debit.

- Resolving payroll queries.

There are various conditions that we are required to be complied with while calculating payroll for NDIS providers as per the SCHADS award. We at PNRC, stay updated with all the conditions yielding the best results for you. We have a team of qualified accountants with a thorough understanding of the SCHADS Award who will help you in fastening the payroll process and bring efficiency to payroll calculation.

For Example:- In ABC Disability services pty Ltd considering that they have 250 employees in their organization and they process a pay run fortnightly i.e 9/01/2023 to 22/01/2023 ( Monday – Sunday).

What happens next?

- Team Leader has to approve shifts on Monday before 5.00 PM for the last fortnight of all support coordinators and other staff.

- On Monday, we will process payroll for management staff, for example, 25 employees.

- On Tuesday, we will process payroll for 100 employees and on Wednesday, we will process payroll for the remaining 125 employees.

- On Thursday, before the end of the day, we will solve the payroll queries of all the staff.

Payroll Tax

Payroll tax is levied on total wages paid or payable by an employer to its employees when the total taxable wages of an employer (or group of employers) exceeds a threshold amount. Payroll tax is self-assessed and lodged by the employer.

The payroll tax rates and thresholds vary between states and territories. Generally, a registered employer needs to lodge a return each month. Monthly returns are due on the 7th of the following month. For example, a return for April needs to be lodged by the 7th of May. Payroll tax is administered by revenue offices in each individual state or territory. A number of key areas of payroll tax administration have been harmonised in Australia.

We, at PNRC, with our qualified team, help you in the lodgement of payroll tax returns before the due date and aid you in avoiding any interest & penalty due to delay in filing the payroll tax return.

NDIS claims

NDIS Claim is one of the crucial parts for an NDIS provider. If NDIS claims are not done correctly, the organization tends to lose money and it may bring a cash crunch in the organization. The NDIS providers have liquidity risk if the claims are done incorrectly.

Our study on the Disability industry concludes that as an NDIS provider if you are hiring an employee whose pay rate is $100, you end up paying around 31% as an additional percentage. For instance, the workers’ compensation insurance is 4-6% of the gross pay, Annual leave is 7.6%, Super is 10.5%, Long Service leave is 2% and other expenses contribute to 4-5%. Hence, by considering the above example, it is very important to claim the right amount for an NDIS Provider.

Having multiple participants at single/multiple places?

For an NDIS provider, it is very common to have multiple participants at either a single place or at multiple places. Your claim as an NDIS provider is based on what services you provide to the participant.

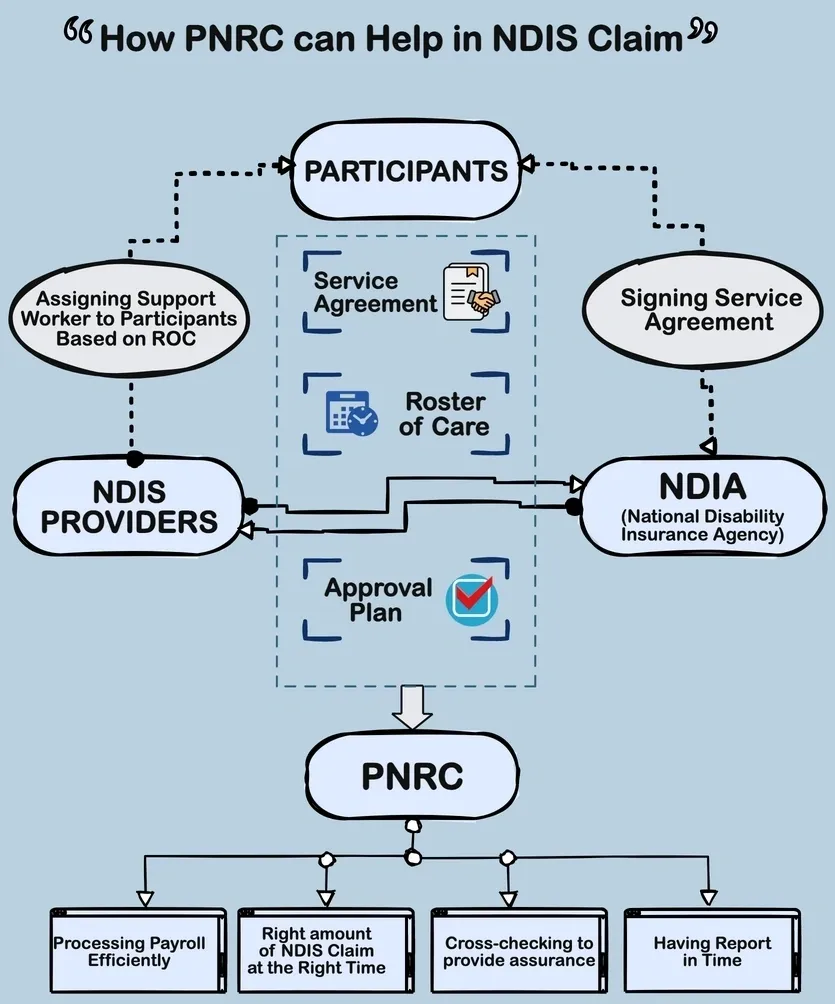

The funding for NDIS is approved by NDIA. We follow the NDIA guidelines and check:

- The Plan is approved by NDIA

- A roster of Care (ROC) is prepared based on the Approved plan

- NDIS signed the service agreement with the participant

The implementation of ROC is a must requirement, Implementation is done by assigning key workers to those participants based on ROC. We also check what support is provided to the participants and whether it is correct as per the service agreement, ROC and approval plan.

The services that are offered by NDIS providers are also cross-checked from the software and by taking details from Team Leader “participants’ wise”.

How PNRC helps NDIS Providers in claiming?

- We check whether the Approved plan, Roster of care and Service agreement are all in the same line or not. If they are not in synchronization, the organisation tends to lose money.

- We prepare the SIL Claim calculation file and record invoices in accounting software.

- We lodge a Claim on NDIS Portal through Bulk file or Manually.

- We check the reason behind the error in the claim and solve that.

- We assess the amount received as per the claim and if the amount received is less, we record the credit note in the books of account and lodge the revised claim after solving the error.

Conclusively, the payroll and the NDIS claim calculation are still the major issues faced by the NDIS industry and they could be troublesome if not configured properly. But with the right accountant, these issues are dealt with professionalism, leading to an effective and optimized growth of the NDIS industry.

For more information, kindly get in touch with us today.