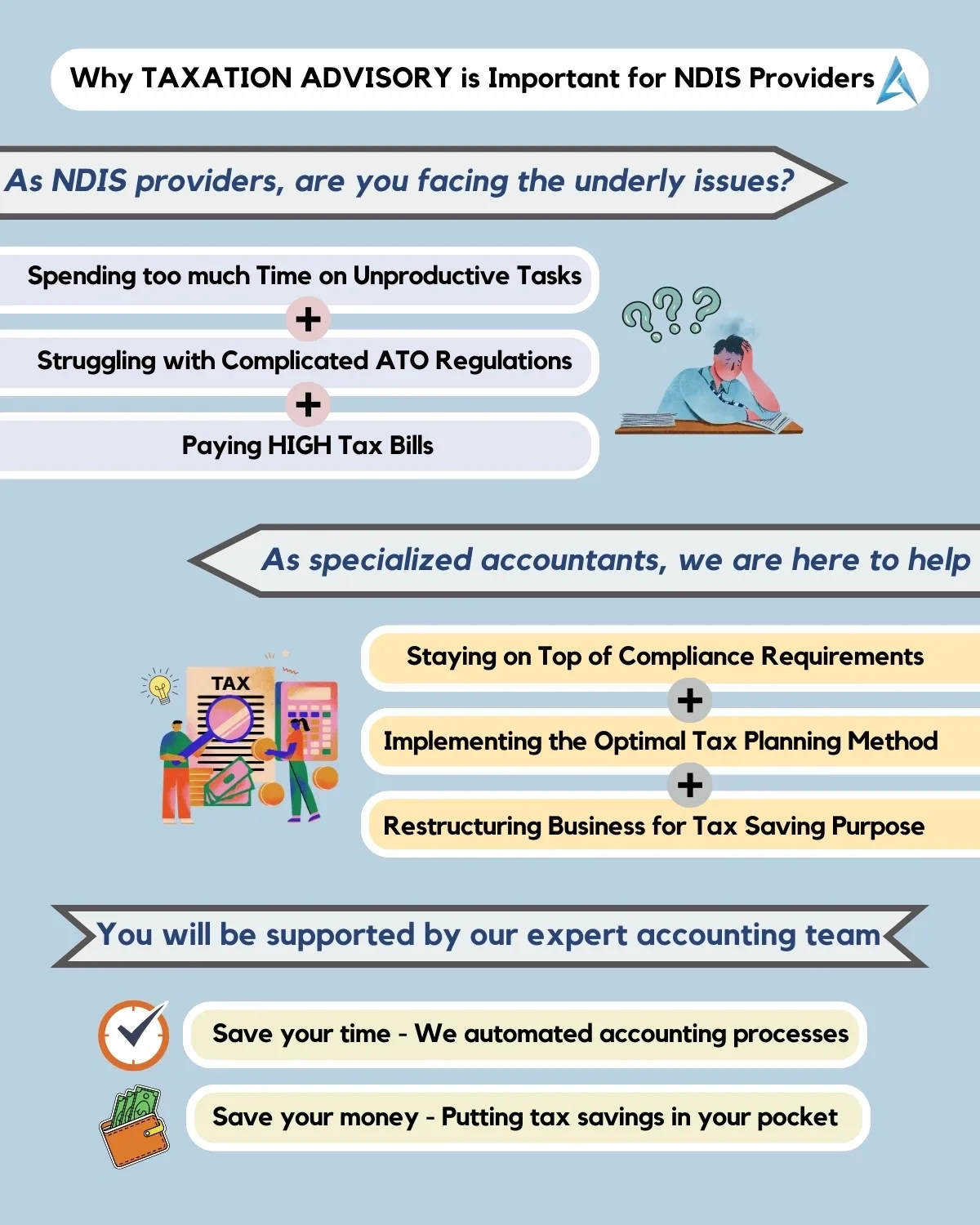

The National Disability Insurance Scheme(NDIS) is a Federal Government-funded scheme that provides financial support to eligible Australians living with an intellectual, physical, sensory, cognitive or psychosocial disability. The NDIS industry is very new and this is why many accountants have very little knowledge of this industry. The problems faced by NDIS providers are:

- Taking too much time to manage complex issues of compliance obligation (unproductive tasks).

- Delay in submitting Business Activity Statements.

- Paying high taxes (than what is required of them probably).

Tax regulations and approaches are continually changing in Australia and internationally, with tax decisions under scrutiny like never before. At PNRC, our tax expertise coupled with deep industry knowledge, helps our clients realise planning opportunities and meet their compliance responsibilities. We think beyond the present and beyond borders to deliver long-lasting value. Some of the areas we help NDIS Providers include:

- Assessing the present business model and understanding the cost of operation.

- Forecasting future growth and managing growth issues.

- Restructure businesses for tax-saving purposes and implement the optimal tax planning approach for NDIS providers.

- Tax compliance, tax planning and growth management.

Our understanding of tax governance, specialist skills and industry knowledge helps our clients to see opportunities and fulfil compliance. With us, as an NDIS provider, you are able to:

- Stay at the top of compliance.

- Minimise taxes and pay the right amount.

- Efficient in managing compliance requirements, allowing NDIS providers to focus on the growth of their business.

We are here to provide you with the best financial support available.

For further information and assistance, kindly get in touch with us today!